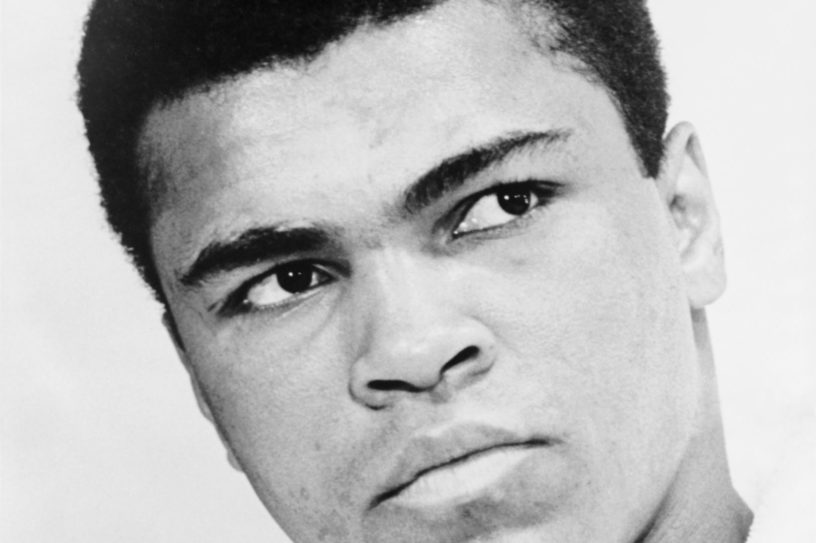

Muhammed Ali’s estate unlikely to avoid punch from IRS

Muhammad Ali, to most boxing aficionados, is the greatest boxer of all time and he let us all know it. We all, including estate planners, find the estate administration of famous people interesting. Maybe it is the size of their estate or maybe it’s what makes up the assets of their estate. No matter who it is, even “the greatest” of us has estate issues.

Muhammad Ali died in June of 2016. He is believed to be worth around $50-80 million. He had a company named Muhammed Ali Enterprises. It was formerly named G.O.A.T. LLC (yup, “Greatest of All Time”). While Ali’s wealth appears large, it is estimated that Michael Jackson, according to the Internal Revenue Service, had a value to his image and name that neared $434 million.

Death taxes or inheritance taxes can be paid at the Federal and State level.

No inheritance tax on estate for Ali, Michigan

Ali lived in Arizona, which does not have an inheritance tax. Michigan also does not have an inheritance tax, unless your estate’s value exceeds $5.45 million. Most of us have no likelihood of having to worry about paying an estate tax, either to the Federal or State government.

It wasn’t that long ago that we did though. Prior to Jan. 1, 2005, had you inherited money from your parents, you would have had to pay the State of Michigan. Remember, in many cases these “death” taxes are on wealth that your parents already paid: income taxes, property taxes, sales taxes, use taxes, personal property taxes and “you name it” tax.

So, when politicians start talking about the tax laws being changed, be cautious. You can do the calculations yourself. While Ali might have been the greatest boxer of all time, his net worth cannot avoid the potential “knockout” punch that the Internal Revenue Service might provide!