Credit Reports Not What They Once Were

While not a BIG part of our legal practice, we have done collection work for years for many small businesses in the Great Lakes Bay area. These businesses range from auto dealers to funeral homes, from landlords to parents, from a decedent’s estate to simple loans between friends.

Recently, we were surprised to learn that the three reporting agencies are no longer reporting money judgments obtained in Michigan’s District Court (under $25,000.00) or Circuit Court (over $25,000.00).

One would think that when someone is sued for example for the non-payment of rent, or money owed for not paying their parents’ funeral bill or for not paying back a loan, that once a judgment has been entered in a court of law the amount owed as determined by the Judge (or Jury) would be reported to one of the three credit reporting agencies. But we have been informed that belief is false.

It was not always this way; in fact, it is our understanding that the court system would routinely report money judgments to reporting agencies. My parents, when they were landlords, would always request a credit report from an applying potential tenant.

Apparently, this became too much of burden for the credit reporting agencies in that they would have to confirm the amount of the judgment and whether or not the judgement was paid in full.

So, what is the big deal?

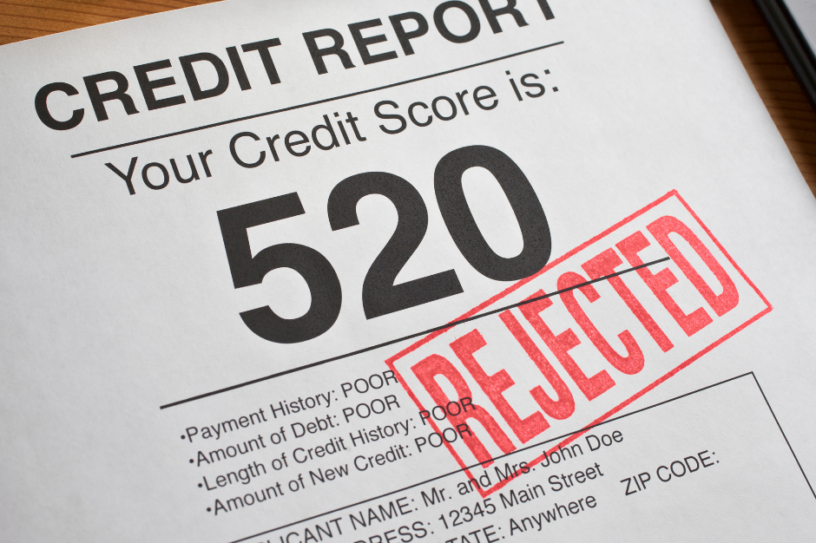

Well consider one simple example of why one’s credit score is important. Assume you are a landlord, and you consider a credit score in determining an individual’s ability pay the rental amount you plan to charge, but the potential tenant’s credit report does not show the potential tenant owes money for having damaged their previous rented premises or that they have not paid a water or utility bill in months.

Remember not all bad payment history results in a money judgment against a debtor, but to inflate one’s credit report due to the non-reporting of debt by the credit reporting agencies, exposes us all to individuals that cannot afford the credit given to them, which costs all those who pay eventually.

Just a tidbit of information for those who still consider a credit report as the litmus test for loaning.